Excitement About Hard Money Atlanta

Get This Report about Hard Money Atlanta

Table of Contents9 Easy Facts About Hard Money Atlanta ShownThe Single Strategy To Use For Hard Money AtlantaNot known Factual Statements About Hard Money Atlanta The Greatest Guide To Hard Money AtlantaAll About Hard Money AtlantaHard Money Atlanta Things To Know Before You Buy

These jobs are normally finished swiftly, therefore the demand for fast accessibility to funds. Earnings from the project can be used as a down payment on the next, therefore, hard money car loans enable financiers to scale as well as flip more homes per time. Provided that the taking care of to resale time framework is short (usually less than a year), house fins do not require the lasting lendings that traditional mortgage lending institutions supply.

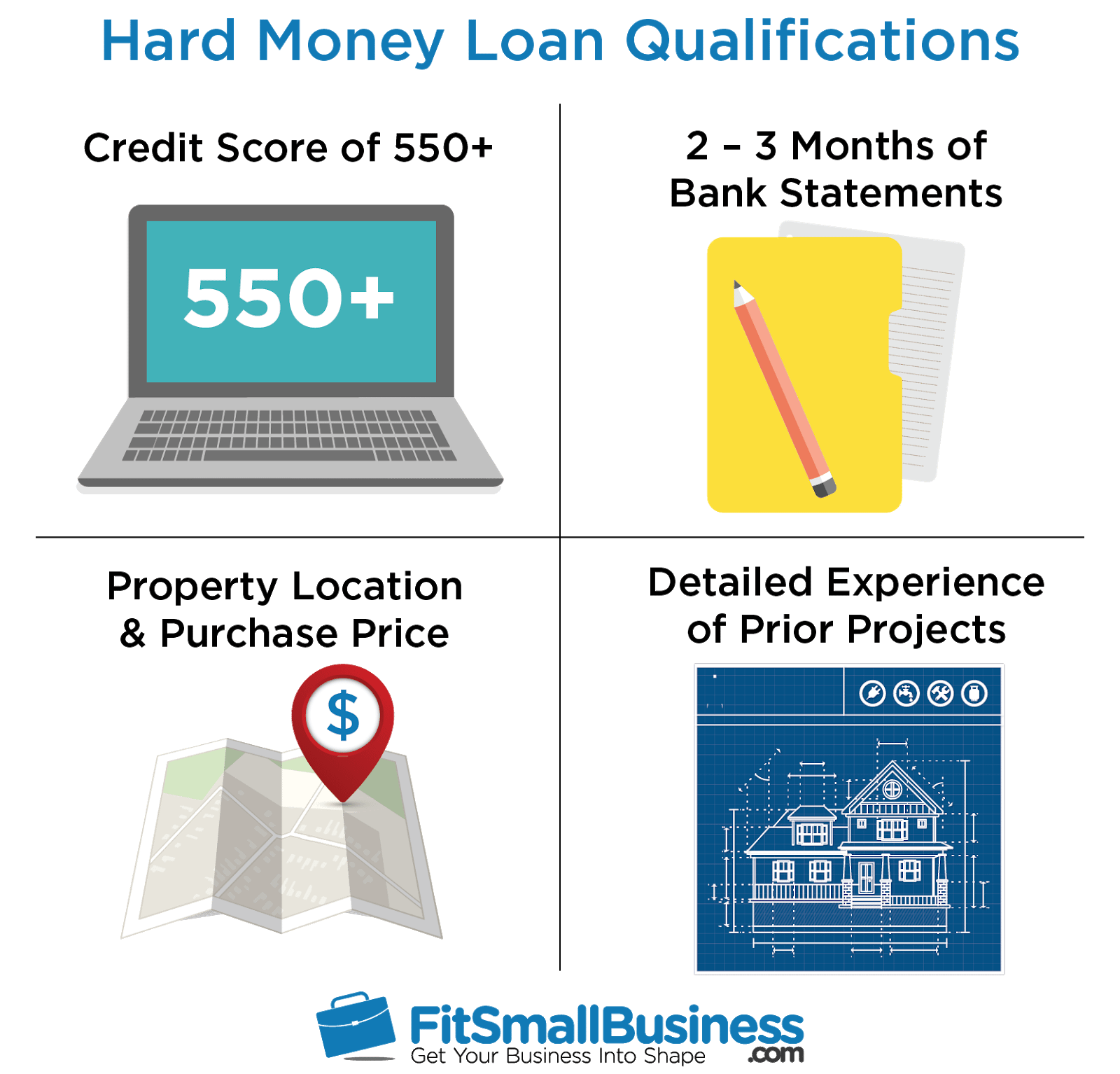

Normally, these factors are not one of the most important factor to consider for car loan credentials. Rather, the worth of the residential or commercial property or property to be purchased, which would additionally be used as security, is largely thought about. Passion rates may likewise differ based on the loan provider and also the deal in concern. The majority of lenders may bill rates of interest ranging from 9% to even 12% or even more.

The 7-Second Trick For Hard Money Atlanta

Hard money lenders would also bill a cost for giving the financing, and also these costs are likewise called "points." They typically end up being anywhere from 1- 5% of the total loan amount, nonetheless, points would typically equal one percent factor of the finance. The major difference in between a difficult money lender and also various other loan providers hinges on the authorization process.

A hard cash loan provider, on the other hand, concentrates on the possession to be bought as the leading factor to consider. Credit history, income, and also other individual needs come secondary. They additionally vary in terms of simplicity of access to financing and rate of interest; difficult cash loan providers provide moneying swiftly and also charge greater rates of interest as well. hard money atlanta.

You might locate one in one of the complying with means: An easy net search Request suggestions from neighborhood real estate agents Request referrals from investor/ capitalist teams Because the financings are non-conforming, you ought to take your time examining the needs and terms provided prior to making a computed and informed decision.

Things about Hard Money Atlanta

It is necessary to run the figures before choosing a hard cash funding to make sure that you do not encounter any kind of loss. Make an application for your difficult money funding today as well as get a funding commitment in 24 hr.

A difficult money loan is a collateral-backed financing, protected by the real estate being acquired. The size of the loan is established by the estimated worth of the residential property after proposed fixings are made.

Many tough money loans have a regard to six to twelve months, although in some instances, longer terms can be arranged. The debtor makes a monthly repayment to the lender, usually an interest-only payment. Right here's just how a common tough cash loan functions: The debtor desires to buy a fixer-upper for $100,000.

3 Simple Techniques For Hard Money Atlanta

Some lending institutions will certainly require more money in the deal, and ask for a minimum down payment of 10-20%. It can be beneficial for the financier to seek out the loan providers that need very little down repayment choices to reduce their cash money to shut. There will certainly additionally be the regular title costs related to shutting a purchase.

Ensure investigate this site to get in touch with the tough money lender to see if there are prepayment fines billed or a minimum return they call for. Presuming you are in the loan for 3 months, and also the building markets for the predicted $180,000, the financier earns a profit of $25,000. If the residential or commercial property costs even more than $180,000, the purchaser makes also more cash.

As a result of the shorter term and high interest prices, there normally needs to be renovation and also upside equity to capture, whether its a flip or rental residential or commercial property. A hard cash car loan is ideal for a purchaser that wants to deal with and turn an underestimated residential property within a relatively short duration of time.

All about Hard Money Atlanta

Rather than the typical 2-3 months to shut a typical mortgage, a hard money funding can commonly be shut within a matter of a couple of weeks or much less. Difficult money finances are additionally helpful for debtors that might not have W2 tasks or lots of gets in the financial institution.

Hard cash lenders will lend as much cash as the rehabbed property is worth. Furthermore, some borrowers use tough cash loans to link the space in between the acquisition of a financial investment building and also the purchase of longer-term financing. hard money atlanta. These buy-and-hold financiers use the hard cash to obtain as well as remodel residential properties that they then refinance with traditional lendings and take care of as rental residential properties.

The Definitive Guide to Hard Money Atlanta

Debtors pay a greater interest rate for a tough cash lending because they don't have to jump through all the hoops required by conventional lenders as well as receiving even additional hints more funds in the direction of the acquisition rate and also improvement. Tough money loan providers take a look at the residential property, in addition to the debtor's plans to enhance the residential or commercial property's value and repay the financing.

When using for a tough cash finance, borrowers need to verify that they have enough resources to effectively obtain with a bargain. (ARV) of the building that is, the estimated worth of the view publisher site property after all enhancements have been made.